Beyond buzzwords: Put the Oxford offsetting principles to work now

- November 6, 2025

The Voluntary Carbon Market (VCM) is a critical tool for climate action, but its complex landscape can make purchasing carbon credits challenging. With growing attention on diverse climate strategies, from nature-based solutions to novel engineered carbon removal, long overlooked superpollutant elimination projects are now coming into focus thanks to big commitments from companies like Google. Superpollutants are non-CO2 greenhouse gases – like methane, fluorinated gases (e.g., old refrigerants), nitrous oxide, and black carbon – that account for nearly half of all global warming caused by human activity since 1970.

Due to stark differences in credit quality and pricing, science-based frameworks are critical to guiding carbon credit purchasing decisions. The Oxford Offsetting Principles offer VCM leaders and newcomers alike a strong foundation for making confident credit purchasing decisions and steering investment to reach global climate targets.

The foundation for impact

With a surge in net-zero commitments and worry that buying carbon credits would replace internal emissions reductions, researchers at the University of Oxford’s Smith School of Enterprise and the Environment first published the Oxford Offsetting Principles in September 2020. The four principles, most recently revised in 2024, provide clear guidance on how to:

- Prioritize emission reduction and use credits to achieve net zero: The first principle emphasizes that organizations must drastically reduce emissions within their own value chains. Emissions that cannot be reduced internally are to be compensated by high integrity carbon credits, which means they must be accurately measured, reported upon, verified, and accounted for. Critically, these investments must be demonstrably additional, have a low risk of reversal, and avoid negative impacts on people and the environment.

- Transition to carbon removal: Although the VCM is currently dominated by avoided emissions, meeting the Paris Agreement requires the dramatic scaling of durable removal projects and increase of carbon credit portfolios’ removal share towards net zero.

- Emphasize on durable storage for removals: This principle distinguishes removal solutions based on their storage durability, prioritizing low risk of reversal.

- Support for innovation: Finally, the Oxford principles encourage the development of innovative and integrated approaches to achieving net zero.

The climate & business case for an Oxford-aligned portfolio

As companies make real strides to reduce emissions, an effective climate strategy requires a holistic approach to carbon credit procurement to maximize impact. Ramping up carbon removal investment will lower the cost curve for novel technologies and lay the groundwork for long-term climate solutions. We cannot, however, ignore the immediate need to direct capital towardhigh-quality avoidance projects that prevent emissions from entering the atmosphere. These projects, such as the elimination of super pollutants, deliver immediate and additional emissions reductions that are crucial for limiting near-term warming.

A long-term Oxford-aligned strategy is also a smart business decision. Under a high-quality scenario where the market becomes dominated by high-integrity high-cost projects, notably driven by technology-based removals, average prices are expected to surge to around $100 per ton by 2050. This price increase will be driven by buyers prioritizing quality, scientific rigor and durability. Therefore, securing portfolios with premium credits today gives companies a strategic edge to lock future value before the market matures towards high-quality supply.

In summary, the Oxford principles advise credit purchasers to:

- Invest in durable carbon removals now: Secure high-quality supply ahead of net-zero years and hedge against future price increase and availability constraints. This provides essential capital today to bring the long-term cost curve down.

- Invest in high-quality, immediate climate impact: Support impactful projects like superpollutant elimination, which are relatively more affordable on a per-tonne basis, but meet rigorous quality criteria.

This dual investment buys the planet critical time for removal work to take effect while financially benefiting organizations by lowering the average portfolio cost today. Stacking these compensation types with immediate, operational emissions reductions allows companies to allocate capital effectively toward their sustainability goals.

Building an Oxford-aligned portfolio, in practice

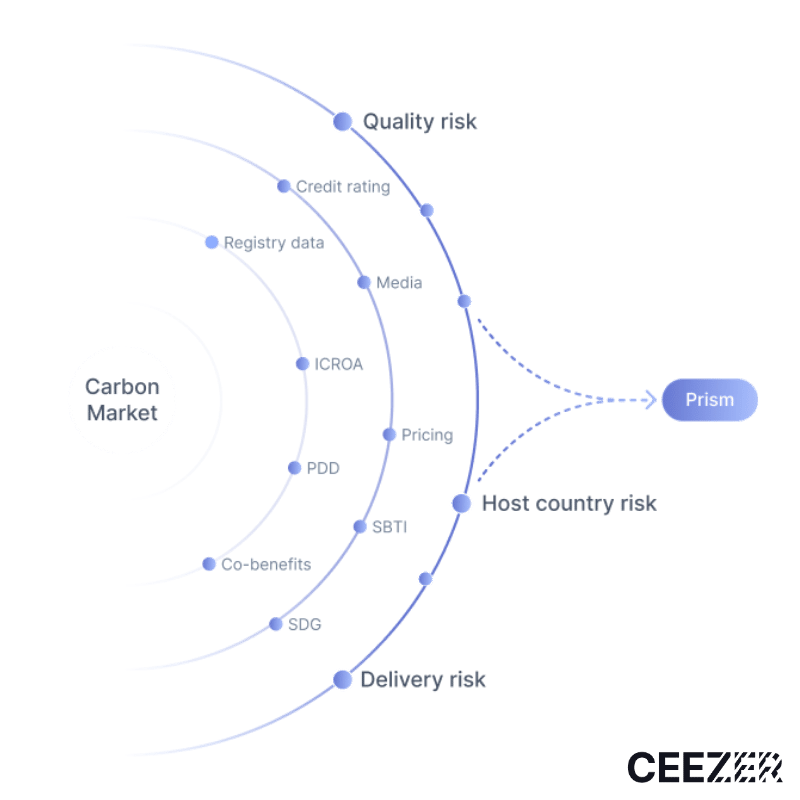

At Tradewater, we collaborate closely with organizations helping buyers build diversified, principle-based portfolios. One of our partners, CEEZER, a leading Berlin-based enterprise platform, uses technology and advisory support to help enterprises make informed purchasing decisions. CEEZER provides corporate buyers with secure access to a curated selection of high-quality carbon projects in the VCM and facilitates direct transactions between enterprise buyers and project developers, like Tradewater.A data-driven approach is key to building diverse, Oxford-aligned portfolios that reduce the risks carried by a single project and technology. CEEZER’s project assessment process involves a rigorous due diligence process analyzing over 400 risk factors aggregated into 50 key risk drivers for each project type. These risks are assessed across crucial dimensions: quality risk (e.g. additionality, carbon accounting rigor or permanence), delivery risk (e.g. issuance timeline or project developer track record), country risk (e.g. political stability and carbon market regulatory landscape), and pricing risk (e.g. project type specific price projection). The CEEZER Prism solution provides a standardized visualization of this data, enabling companies to make informed purchasing decisions and maintain the integrity of their carbon credit portfolios over time through real-time monitoring.

A systematic, data-driven approach is particularly vital for engaging in long-term offtakes, multi-year agreements to purchase carbon credits. Long-term offtakes enable projects to scale while guaranteeing delivery of high-quality credits until a company’s net-zero date. This strategic long-term approach aligns with the Oxford Offsetting Principles by providing the capital needed to scale CDR while preventing the release of greenhouse gas emissions into the atmosphere today.

Onward and upward

Principled decisions drive effective climate action. Many organizations already demonstrate sustainability leadership by purchasing carbon credits, while others are beginning to define their approach. The Oxford Offsetting Principles provide a practical framework to guide investment toward balanced, well-structured portfolios.

A strong strategy addresses both immediate priorities—cutting internal emissions and supporting high-quality avoidance projects—and longer-term needs, such as scaling durable carbon removal. High-quality avoidance can include top-rated superpollutant elimination credits, like Tradewater’s, that deliver rapid, measurable impact. Alternatively, organizations can also work with experts like CEEZER, which apply rigorous compensation principles, conduct project due diligence, evaluate risk, and structure multi-year offtakes that maximize impact.

By pairing principled decisions with proven partners, organizations can turn carbon credit strategies into lasting climate impact.

Read our other blogs

California’s pivotal role in increasing transparency in the carbon market

California’s AB 1305 marks a significant shift in how companies must engage with and report…

Why repeat climate funding matters: How multi-year buyers are unlocking high-quality climate impact

Climate change is a long-term challenge – and solving it requires long-term commitments. As climate…

Beyond Buzzwords: Put the Oxford Offsetting Principles to Work Now

Science-based frameworks are critical to guiding carbon credit purchasing decisions. The Oxford Offsetting Principles offer…